1031 Exchange Specialist In Tucson, Arizona

What is a 1031 exchange and the timelines involved?

In this article, we are going to address what a 1031 exchange is, the 1031 exchange process, the timelines and tax benefits when doing a 1031 exchange.

Table of Contents

What Is A 1031 Exchange

A 1031 exchange is a tax-deferred exchange of real estate that allows investors to sell an investment property and reinvest the proceeds into a new property without having to pay capital gains taxes on the sale. The name “1031” comes from Section 1031 of the Internal Revenue Code, which outlines the rules and requirements for such exchanges.

To qualify for a 1031 exchange, both the original property and the replacement property must be held for investment or business purposes, and the replacement property must be of “like-kind” to the original property. Additionally, a qualified intermediary must be used to facilitate the exchange, and there are specific timelines that must be adhered to in order to qualify for tax-deferred treatment.

The primary benefit of a 1031 exchange is the ability to defer capital gains taxes on the sale of an investment property, allowing investors to reinvest their profits and potentially build wealth through real estate investing. However, it’s important to work with experienced professionals, such as a qualified intermediary and a tax professional, to ensure compliance with IRS regulations and maximize the tax benefits of the exchange.

1031 Exchange Process Steps

The basic process steps when doing a 1031 exchange:

- The exchanger signs a contract to sell the relinquished property to the buyer.

- The exchanger finds a Qualified Intermediary and enters into an exchange agreement to retain the Qualified Intermediary to handle the 1031 Exchange.

- At the closing of the relinquished property, the exchange funds are wired to the 1031 Exchange company hired.

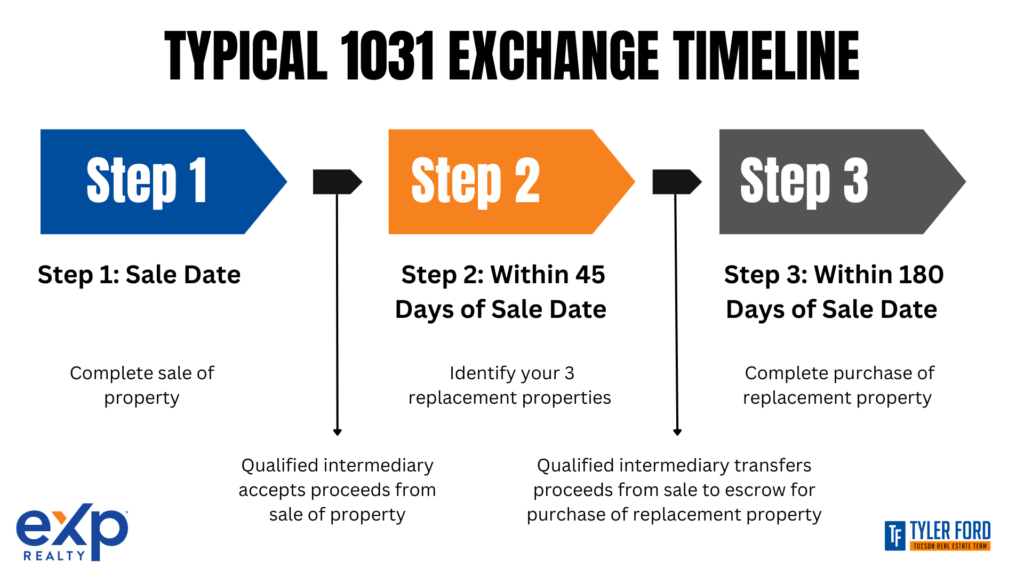

- The exchanger has a maximum of 180 days to acquire and close on the replacement property.

- The exchanger must identify possible replacement properties in writing to the Exchange Company within the Zero-to-45-day period. Day zero is the closing date of the relinquished property.

- The exchanger signs a contract to purchase replacement property with the seller.

- Exchanger assigns the exchangers rights in the purchase contract to the Exchange Company exchanger selected.

- At the closing of the replacement property, the Exchange Company wires the exchange funds to the escrow company to complete the exchange.

- The exchange company instructs the escrow officer to transfer the deed directly from the seller to the exchanger.

1031 EXCHANGE TIMELINE

What Are The Exchange Requirements of a 1031 Exchange

To qualify for a 1031 exchange, there are several exchange requirements that must be met:

Like-Kind Property: The property you sell and the property you acquire must be “like-kind,” meaning that they are of the same nature or character. This means that any real property held for investment or business purposes can be exchanged for any other real property held for investment or business purposes.

Investment or Business Property: Both the original property and the replacement property must be held for investment or business purposes. Personal residences or vacation homes do not qualify for a 1031 exchange.

Qualified Intermediary: To ensure compliance with IRS regulations, a qualified intermediary (QI) must be used to facilitate the exchange. The QI holds the proceeds from the sale of the original property and uses them to purchase the replacement property on behalf of the taxpayer.

Timing Requirements: As mentioned earlier, there are specific timelines that must be adhered to in a 1031 exchange, including the identification period and exchange period.

Reinvestment of Proceeds: The full proceeds from the sale of the original property must be reinvested into the replacement property. If any funds are retained by the taxpayer, they will be subject to capital gains taxes.

Title Requirement: The taxpayer must receive the same title to the replacement property as they held for the original property.

Are 1031 Exchange Qualified Intermediary Licensed and Bonded?

Yes, 1031 exchange-qualified intermediaries are typically licensed and bonded. In fact, most states require qualified intermediaries to be licensed and bonded in order to operate legally. This helps to protect taxpayers from potential fraud or mismanagement of funds during the exchange process.

The specific licensing and bonding requirements for qualified intermediaries can vary by state, so it’s important to research the regulations in your state and ensure that any potential intermediary you work with is in compliance. It’s also recommended to work with an intermediary who is experienced and reputable in the industry, and who has a track record of successfully completing 1031 exchanges.

Overall, working with a licensed and bonded qualified intermediary can help provide peace of mind and ensure that your 1031 exchange is conducted in compliance with all applicable regulations.

When doing a 1031 exchange, make sure you work with a 1031 exchange company that is licensed and bonded!

Watch this interview with 1031 Exchange Company and Qualified Intermediary: 1031 Exchange Company FAQ

Tax Benefits of Doing a 1031 Exchange

There are several tax benefits of doing a 1031 exchange, including:

Tax Deferral: The most significant benefit of a 1031 exchange is the ability to defer taxes on the capital gains from the sale of your original property. This means that you can reinvest your profits in a new property and avoid paying taxes on the gains until you sell the replacement property.

Depreciation Recapture Deferral: In addition to deferring taxes on the capital gains, a 1031 exchange also allows you to defer depreciation recapture taxes. When you sell a property, you must recapture the depreciation deductions you claimed during ownership, and pay taxes on that amount. However, in a 1031 exchange, you can defer those taxes and continue to claim depreciation deductions on the replacement property.

Estate Tax Deferral: If you pass away while still owning the replacement property, the deferred taxes from the original property are forgiven, and your heirs inherit the property with a new, stepped-up basis. This means that the heirs could potentially sell the property without paying any capital gains taxes.

Portfolio Diversification: A 1031 exchange also allows you to diversify your real estate portfolio by exchanging one property for another in a different market or asset class. This can help mitigate risk and improve your overall investment portfolio.

disclaimer: please see counsel from a certified tax accountant when selling an investment property. In no way is the article intended to give you tax advice.

In Conclusion

Overall, a 1031 exchange can be a powerful tool for real estate investors looking to defer taxes and reinvest their profits. However, it’s essential to work with experienced professionals, such as a qualified intermediary and a tax professional, to ensure compliance with IRS regulations and maximize the tax benefits of the exchange.

If you need help with a 1031 Exchange in Tucson, Arizona reach out to us today. We would love to help!