U.S. FORECLOSURE RATES LOWEST IN 20 YEARS!

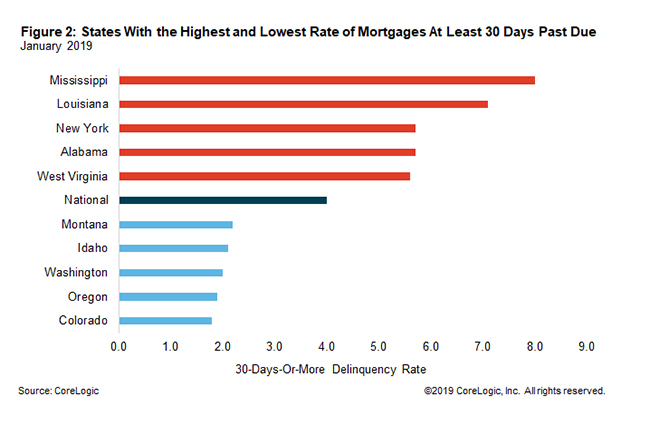

The nation’s overall delinquency rate was 4 percent.

No state logged an annual gain in its serious delinquency or foreclosure rate; only North Dakota posted a gain in the overall delinquency rate.

In January 2019, 4 percent of home mortgages were in some stage of delinquency[1], down from 4.9 percent a year earlier and the lowest for the month of January in at least 20 years[2], according to the latest CoreLogic Loan Performance Insights Report. The measure, also known as the overall delinquency rate, includes all home loans 30 days or more past due, including those in foreclosure. For the month of January historically, the share of delinquent mortgages peaked in 2010, at 12 percent. Since March 2018 the overall delinquency rate each month has been lower than during the pre-crisis period of 2000 through 2006, when the rate averaged 4.7 percent.

The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.4 percent in January 2019, down from 2.1 percent in January 2018. The serious delinquency rate for January was below the average of 1.5 percent for the 2000 – 2006 pre-crisis period. The foreclosure inventory rate – meaning the share of mortgages in some stage of the foreclosure process – was 0.4 percent in January 2019, down from 0.6 percent a year earlier. January’s foreclosure rate was the lowest for that month in at least 20 years and was below the average pre-crisis level of 0.6 percent. Rising home prices have led to record amounts of home equity, reducing the risk of foreclosure.

The share of mortgages that were 30 to 59 days past due – considered early-stage delinquencies – was 1.9 percent in January 2019, down from 2 percent in January 2018. The share of mortgages 60 to 89 days past due was 0.7 percent in January 2019, down from 0.8 percent in January 2018.

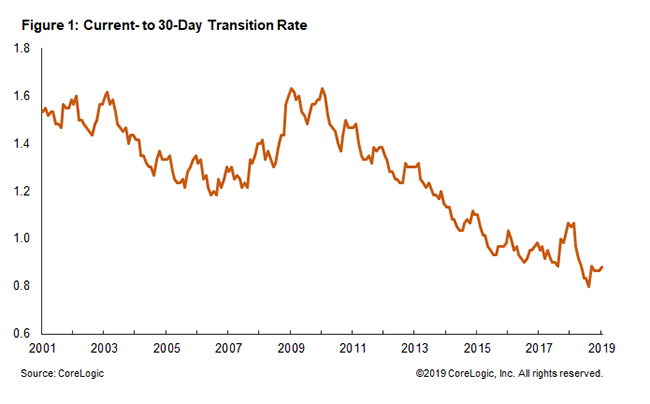

In addition to delinquency rates, CoreLogic tracks the rate at which mortgages transition from one stage of delinquency to the next, such as going from current to 30 days past due. Figure 1 shows that in January 2019 the current- to 30-day transition rate remained well below levels during the housing crisis. The January current- to 30-day rate was 0.8 percent, unchanged from a year earlier. The 30- to 60-day transition rate was 14.9 percent in January, up from 14 percent in January 2018, while the 60- to 90-day transition rate was 24.9 percent last January, down from 26.5 percent a year earlier.

Figure 2 shows the states with the highest and lowest share of mortgages 30 days or more delinquent. In January 2019, that rate was highest in Mississippi at 8 percent and lowest in Colorado at 1.8 percent. North Dakota, up by 0.1 percentage points, was the only state to post an annual increase in the 30-plus-day delinquency rate.

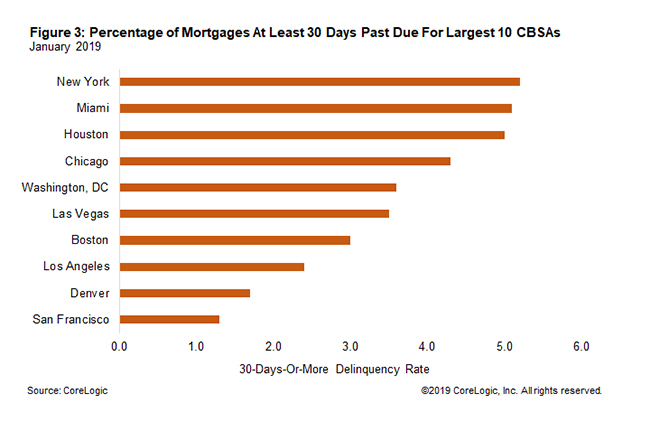

Figure 3 shows the 30-plus-day past-due rate for January 2019 for the 10 largest metropolitan areas.[3] The New York metro had the highest rate at 5.2 percent. Miami, with the second-highest rate at 5.1 percent, saw a sharp decrease in the overall delinquency rate, falling from 10.5 percent in January 2018. San Francisco had the lowest 30-plus-day delinquency rate in January 2019 at 1.3 percent. Houston also saw a large year-over-year decrease, from 9.1 percent in January 2018 to 5 percent in January 2019. Outside of the largest 10, a dozen U.S. metropolitan areas posted an annual increase in their overall delinquency rate, with the highest gains in five hurricane-ravaged parts of the Southeast (in Florida, Georgia and North Carolina) and one in Northern California’s Chico metro area, home of last year’s devastating “Camp Fire.”

To get the latest Tucson Housing Market News visit: CLICK HERE